Aripyanfar wrote:

Oh whoops, I meant to address that, and forgot. National economies go through cycles of high and low revenue. Usually low revenue coincides with higher unemployment and a higher need for public spending, and high revenue coincides with higher employment and lower need for public spending. So governments MUST be able to identify the "good" years, and build surpluses, or balance their budgets, so that they can sanely go into deficit when it is necessary and prudent to do so. Saving for inevitable cyclical emergencies, so to speak.

Ok. Good point. However, those are "natural" effects on spending and revenue though. Revenue drops because economic activity decreases during a recession. It doesn't drop because we lowered tax rates, right? Similarly, spending increases because more people are in need of existing social services. We don't increase the scope of those services, right?

But this recession is different than the last 2 or 3 because the Dems did increase the scope of social services. They passed legislation to create new benefits, and new programs, and new objectives. Thus, we had more than the usual revenue/spending gap we'd expect in a recession of this type. That in turn created greater deficits than normal. Which created greater debt accumulation, which lead to fears of rising taxes to pay for it, which in turn (according to us conservatives) has caused businesses to be hesitant to invest as strongly in the domestic market than they would normally.

As I've pointed out in past threads, there's a reason why the Democrats predicted summer of 2010 would be the "summer of recovery". It's because past recessionary trends followed a very predictable pattern, and that pattern said that we should have started to recover at that time. But we didn't. So. What changed? Like I said, we spent more money than in past recessions. We didn't just end out spending more to provide existing services to an increased number of people, but actually increased the number and type of services (and other stuff) that we were spending money on. That's what changed. That's why this recession isn't starting to recover after 2 years like we saw with the dotcom and 9/11 crashes, and the S&L crash.

Quote:

It is disingenuous to point at public spending jumping to 25% of GDP under Obama in isolation.

I'm not though. Even in past recessions, spending didn't increase nearly that much. Surely you can acknowledge that we didn't just spend more money because more people were in need of existing services, but that we also expanded services and created new areas of spending? My statements are not in isolation. My statements are in full recognition that we spent more money on "new things" during this recession instead of just spending more on existing things as a natural consequence of the recession itself.

Quote:

It is perfectly clear that this is a result of the US and global commercial banking industry going into meltdown and causing the Global Financial Crisis. Any Republican politician, any politician at all, who said that they would not have gone into the same levels of debt as Obama to bail out the banks, everyone's finances, and provide a huge stimulus in the face of a looming Depression, is either a liar or catastrophically ignorant.

I disagree. Many conservatives and most GOP politicians opposed spending more than just the TARP. They did that precisely because they did not believe we needed to spend more than that money to address the immediate problems caused by the housing bubble collapse, and that to spend more money would hurt economic recovery.

Guess what? Looks like they were right!

Quote:

Every economist and politician agrees that the GFC was the biggest global economic crisis since the Great Depression.

Because of its worldwide effect? Sure. But that's not the same as every economist and politician agreeing that the Recovery Act the Dems rammed through congress and a half dozen other "stimulus related" bills and amendments to bills that they added on top of that.

Quote:

Yes, your debt is so high you're fucked. No, NO ONE COULD HAVE PUT THE USA IN A BETTER POSITION THAN IT IS NOW.

False. Had the GOP been in control of Congress in 2008 and retained the presidency (and congress) in 2009, we would be in a vastly better position than we are right now. If you can't see this, it's a failure of your own ability to see beyond a very narrow set of ideological assumptions, and not because those possibilities don't exist.

Quote:

Letting the banks fail or letting the private sector cope alone with the GFC would have made things exponentially worse than they are now.

Sure. But that's not what the GOP proposed. We wanted to do TARP. Bail out the banks. Maybe even do a small token stimulus via direct checks like Bush did (twice). Doesn't cost too much, doesn't hurt to much, and doesn't help too much either. But it does make people feel better, so there's something. What we opposed was the massive spending in the recovery act and other stimulus related spending that followed for the next year and a half.

We did not need to spend that money. We did not need to do anything more than stop the financial institutions from failing, provide them enough capital to recover, and then allow the economy to recover naturally as a result. The negatives in the economy were because of the financial failures. Fix the failures, and those negatives will turn around. You don't need to do anything else.

We're in this mess, not because of the GFC, but because of the Democrats reaction to the GFC. They used the fear at the time to pass spending that in many cases had

absolutely nothing to do with economic recovery. The Democrats, for the first time in 40+ years had sufficiently high numbers to pass a whole laundry list of things their lobbyists wanted. And despite the fact that we were in a recession and could not afford these things, they decided to spend massive amounts of money on them anyway.

That's why were in this debt crisis. It had nothing to do with the initial financial problems. Had we just done TARP and stopped there, we'd be fully recovered right now, probably down below 6% unemployment, likely never have exceeded 8% unemployment (another prediction they made based on past recession patterns which didn't happen because of their own actions), and we'd all be looking back on it like it was no big deal. Instead, as I have said in the past, the Democrats ideologically hindered economic platform is leaving us at the bottom of a recessionary pit, looking up and wondering how to get out.

Quote:

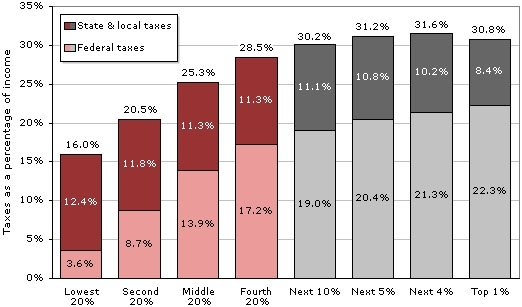

So you are just going to have to suck it up and pay the deficit down in the long term with higher taxes. As one of the above tables shows, The top 25% of your population CAN AFFORD IT.

Not the issue. Tax rate changes didn't create the deficit. Too much spending did. Fix the spending and the rest will fix itself. Or do we once again refuse to listen to the conservatives despite that they seem to be right about 99% of the time about these things?